Is Insurance worth it?

Many clients ask us whether risk insurance is value for money and yet they always seem to pay their car insurance, contents insurance and house insurance without batting an eyelid, because that is what one does.

This is the story of just one of our clients, and there are many others, equally compelling. When we met in 2015, our client had no risk insurance, but took our advice and placed their insurances through Six Step Financial Ltd.

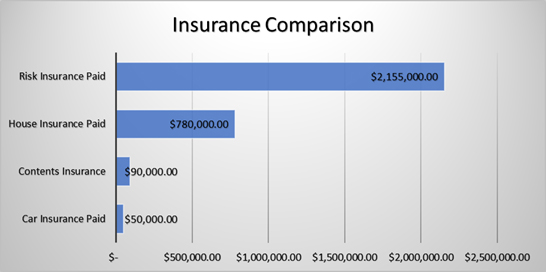

This is what their insurer has paid her to date:

Lump sum Benefits (Life cover Trauma and TPD): $1,110,407.00

Income Protection: $502,015.68

Medical Insurance: $527,580.52

Total: $2,155,003.20

Unfortunately, she has now passed, but this money gave her family some real options and choices. Poignantly her Husband and Mom came up to me before her memorial and said, “Mike we would have lost the farm without this cover so thank you”.

You decide whether risk insurance is worth it, what we fervently hope is that it will be a complete waste of money and you won’t need it, but can you take that risk!

Our client stories of success

Lindy's story

Lindy says “without insurance, she believes she’d have sold her house and be living in a caravan – or dead”. Play the video below to hear her story…

What our clients say about us

Since taking up your financial advice, to move my KiwiSaver account from my Bank to Generate, I have immediately seen a fantastic growth in my fund.

In the six months or so that I have now been with Generate, I have accumulated more Investment Return, than I did in the last three years with my Bank!

Thank you again for the sound advice you gave me, and explaining how important it is to continue to contribute to my account even when there maybe a slight dip in the fund balance. From your white board explanation of what happens in these situations, I understood more fully how your investment can then leap forward quickly again with how Generate invests your money.

Well if I would have known I would have recorded Theodore opening your Paw Patrol birthday card on Saturday. He was one very excited 3 year old. Well done team.

With regards to mortgage protection, I’m so grateful I kept it. I was going to cancel this in 2015 when my ex-husband and I split and we sold the house (I am still renting and cannot see this changing) but Pete convinced me not to. As it turned out it was good that I didn’t cancel it, as I hurt my shoulder and was off work for 16 months.

One usually has insurance for peace of mind, but while playing tennis last year I suffered a heart attack. I didn’t think it could ever happen to me. My Trauma insurance provided us with funds when we really needed it.

I have claimed on my medical insurance many times including for both my hips and my busy lifestyle and business would have been severely impacted if I had to wait for the DHB to schedule my surgeries, I would highly recommend medical insurance.

I went to work as per normal on Wednesday morning, by Thursday I was in hospital and by Friday I was in ICU. My trauma cover pay-out and the advice I received from Pete, ensured my business continued to operate without me and I returned to my normal life when I recovered. It was invaluable to my business and my family in a very difficult time for me.

Thank you so much Kay and Mike for all your help with organising my insurance claim. I feel incredibly grateful that Peter suggested we add to our existing medical insurance by including Partners Life with a $10,000 excess. I have been able to have the surgery now which was denied by my other insurer and which the surgeon suggests was definitely life saving.

I fell ill some years ago and I was forced to be away from work for several months. My Business Protection policy paid my firm over $150,000 over this period, while I was not there to contribute. If I had not had this insurance in place, it would have created significant hardship for not only myself but my partners and staff.

I was self employed a while back when a joist gave way under me during a renovation project. I fell from a height of 3 meters causing me to fracture my back. The Income Protection Mike recommended assisted me financially and enabled me to concentrate on my rehab over the following months. This was my second claim, I had previous claimed due to a snow boarding accident which resulted in a broken wrist. I would recommend income cover to anyone who is self employed!

I had sold my farm in 2010 and was wanting to cancel my income protection insurance. Pete insisted I keep it and thank goodness I listened to him. In 2012 I was diagnosed with Lymphoma cancer my insurance paid me a lump sum Trauma amount, as well as about 24 months worth of my income protection. I recovered following chemotherapy treatment and a stem cell transplant and returned to sea back in February 2014.

In 2019 I was crook again with Lymphoma needing more treatment and luckily back on insurance claim. Unable to get a marine medical clearance to return to sea, I now rely on my income protection to live on, which is still being paid to me each month, now well over 3 years later… I believe this has been a vital ingredient and helped to keep me in good health today.

Being one to regularly review my insurances, I was pleasantly surprised to learn from Mike at one of these reviews that I had a claim for my kneecap I had fractured in a fall a few months prior to the meeting. This was an unexpected windfall when I really needed it. This has definitely reinforced my opinion of the value of having insurance in place.

On a recent review with Mike and Pete I discovered to my surprise that I had a claim for an injury to my wrist I had done nearly 6 months back. The claim that was paid to us really helped us to navigate Covid and couldn’t have come at a better time, my advice – always review your insurance!

When I fell an injured my back, ACC declined to pay for the surgery I needed, saying it was degenerative due to my age. I was relieved to have my Private insurance cover which paid for my surgery which was unaffordable yet essential to my recovery.